1.1. Introduction to money

1.1.1. Money and its functions

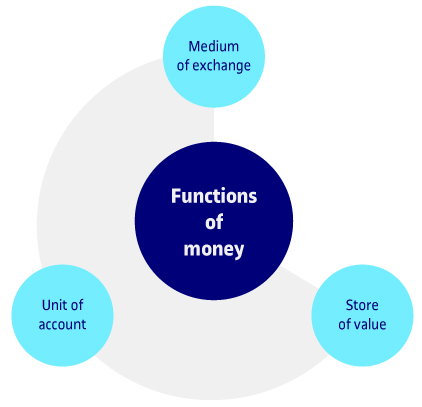

When it comes to defining what money is, authors tend to refer to its specific functions:

- Medium of exchange: Money facilitates the exchange of goods and services within a community or market.

- Unit of account: Money is used to measure the value of items and determine exchange prices.

- Store of value: Money need not be used in the moment and can be accumulated or hoarded for future necessities.

However, the essence of money, true to its origins, lies in the first two functions: as a medium of exchange and a unit of account. The most widely-used definition directly relates to the original concept of money as an “agreement among the members of a community of people to use something as a symbol of value for the exchange of goods and services”. This definition incorporates two concepts which are fundamental to an understanding of money: the presence of a “community” of people and the “agreement” among them to accept something as a unit of exchange.

In spite of this definition, money has ceased to be an instrument of exchange for the promotion of prosperity. Instead it has become a universal end in itself, upon which people depend to determine their quality of life and satisfy their needs and wants. When the store-of-value function prevails, money generates a cumulative increase, supported by “interest” (the cost of money when it is loaned) and “compound interest” (the cost of the money implicitly included in the goods and services we acquire). When money becomes an end in itself, in a generalized way, societies become morally sick, giving rise to important social injustices, unequal distribution of financial, social and environmental burdens, a widespread lack of solidarity among citizens and the dehumanization of relationships.

Legal tender, as we know it today, promotes the use of the three different functions, but with excessive emphasis on the store-of-value function, with all its implications. Complementary currencies, on the other hand, seek to achieve the first two functions, but never the third, as will be discussed later in this COURSE. Certain complementary currency projects are even introducing the concept of “oxidation” expounded in the theories of Silvio Gesell. This refers to a negative interest rate which causes money to lose value over time, thereby discouraging hoarding and the perpetual circulation of money.