1.4. Sustainability of monetary diversity

1.4.3. The sustainability of monetary diversity

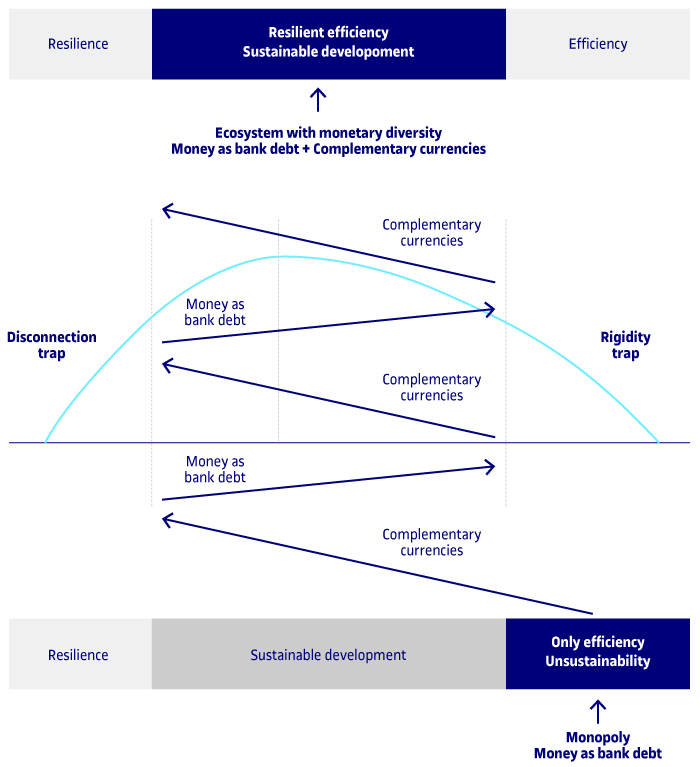

The conventional economic idea accepts de facto the monopoly of national currencies as indisputable. By contrast, evidence points to the conclusion that monetary sustainability requires a diversity of currency systems to enable numerous and diverse channels of monetary exchange and connection. Efficiency is undoubtedly reduced, but at the same time transactions are facilitated that otherwise would not take place, thanks to a diversity and connections that otherwise would not exist, and thus the response capacity of the economy in general is increased.

Complementary currencies can have an effect at any time, whether pre-emptive of (before) or reactive to (after) a financial collapse or crisis per se.

Prior to a collapse (Figure 9), the effect will be to draw the system progressively nearer to the area of viable sustainability, due to decreased efficiency and the converse increased resilience.

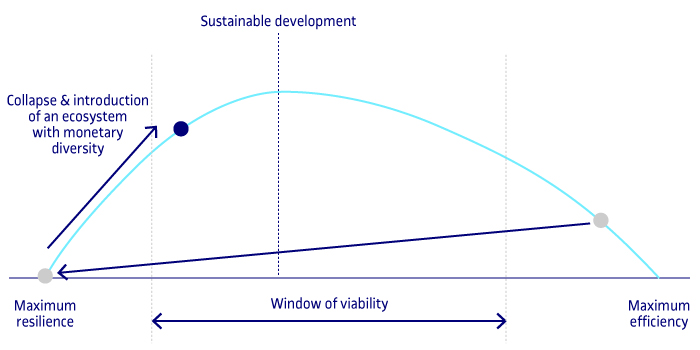

Subsequent to a collapse (Figure 10), the effect of the complementary currencies will be analogous to any natural system: the system will progressively recover its efficiency with little loss of resilience, all the time drawing nearer to its optimal sustainability point.

A more sustainable monetary system would therefore tend to be an ecosystem with a broad variety of currencies and agents with different regional scope, all coexisting simultaneously (Figure 11). This new arrangement would go beyond money as bank debt monopolized by nations and financial giants. Rather, it would be an intelligent strategy of diversification and interconnectivity that would increase sustainable development at the same time as strengthening the resilience and therefore the sustainability of the monetary ecosystem itself.