2.2. Typologies

2.2.1. The different typologies

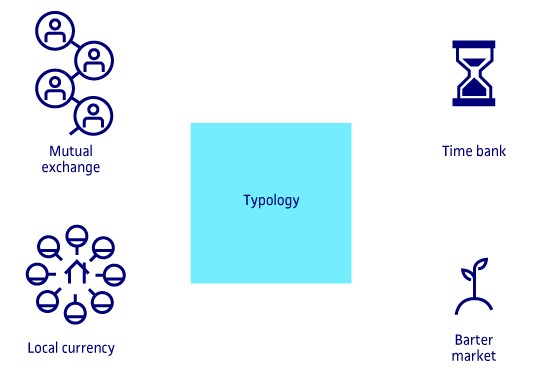

Let us look first at the four different typologies of existing complementary currencies, according to the categories defined by Gill Seyfang and Noel Longhurst in 2013. This classification defines complementary currencies as interventions intended to strengthen local cooperation, offer additional liquidity and motivate environmental initiatives, in pursuit of a three-way balance of social, economic and environmental activities.

- Mutual exchange. These are monetary systems which are created by their own members and based on trust. Members advertise goods and services according to ‘wants’ and ‘offers’ in a directory, while a central accounting system records the transactions that take place. The currency per se is created in the moment of the transaction, whereby both ‘buyer’ and ‘seller’ are committed to the system. These systems are based on trust, under which one member’s spending equals a debt to the other members. They usually exist in a civil society context, often with little encouragement from governments or other funding sources. One of the best known mutual exchange systems is the Local Exchange Trading System (LETS).

- Service credits. These initiatives are similar to mutual exchange systems, but restricted exclusively to the exchange of services. The currency unit is based on time, and the system operates via a central exchange that links services wanted and offered. Everybody’s time is worth the same under these exchange systems, irrespective of the service provided. Service credit is earned by helping other people and organizations, and can be spent on services offered by other members. Service credit systems, or time banks, are set up in neighbourhoods and communities, often by volunteers, some of whom are sponsored by institutions. These systems often focus on a specific sector, such as health care, education or justice, and their primary objectives are to encourage inclusion, cohesion and the building of social capital.

- Local currencies. These are monetary systems which are geographically defined and circulate within a certain region. Their objectives are to promote economic activity in the region by supporting local economy and speeding up exchange and circulation, thus encouraging the associated multiplier effect and preventing ‘leakage’ of money from the area. Local currencies are not intended to supplant either the legal tender currency or interregional trade. While many local currencies have actual paper money, others only use technological platforms, including debit cards and mobile telecommunications. In recent years, the public sector has begun to become involved with local currency initiatives, having perceived an opportunity for public sector policies that generate local wealth and increase monetary circulation, at the same time as they empower local business and the local population.

- Barter markets. These are a hybrid of mutual exchange and local currencies systems. They consist of an infrastructure which enables participants to exchange goods and services within the framework of a site-specific event, such as a market, fair or festival. They are associated with civil society cooperative economy initiatives, with a strong emphasis on promoting sustainable development by reusing goods. Barter markets are designed to overcome the scarcity of legal tender money and facilitate exchanges among a group of users. They tend o be associated with the concept of ‘prosumers’, meaning that the participants have to be both producers and consumers.