1.2. Unsustainability of the monetary monopoly

1.2.2. Behaviour of the current monetary system

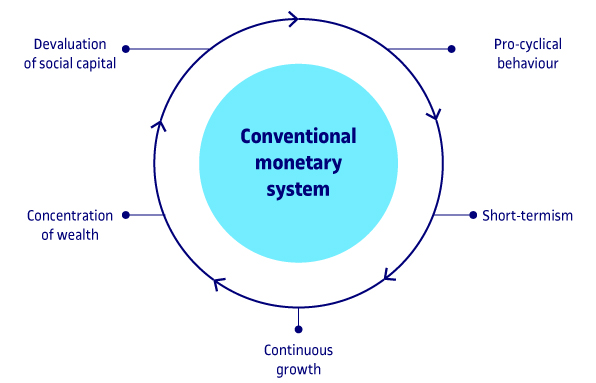

According to the prevailing perception of money, the economy is a closed system, unrestrained by and completely disengaged from the social and environmental externalities that it generates. This perception and the characteristics of conventional money combine to make the current system the cause of serious challenges to the sustainability of both society and the environment, including the following:

- Environmental unsustainability derived from the compulsive promotion of production and consumption. Economic growth, as it is currently perceived, is intensive in the consumption of generally non-renewable natural resources, the loss of which the environment is unable to assimilate. This development model is environmentally unsustainable on a finite planet such as ours.

- Socioeconomic unsustainability derived from the monopolistic perception of the current monetary paradigm and the issue of money mechanism. All of this promotes competitive, individualistic behaviour that favours the concentration of wealth. The economic growth model also constitutes a source of social unsustainability through the inequitable distribution of its externalities, such as the generation of waste, pollution, and the degradation of the environment and biological and sociocultural diversity.

- Among the other consequences of the functioning of the current monetary system, particularly associated with the fact that money is created through bank debt with interest, are the following five structural failings:

- Pro-cyclical behaviour. Conventional modern money is created as bank debt, which exaggerates fluctuations in the economic cycle and renders it more vulnerable to disturbances. When all is going well and the forecasts are favourable, the banks offer credit on generous terms, which tends to fuel periods of inflation. When things go wrong and the future forecasts are gloomy, the banks drastically reduce their lending, which translates into periods of recession.

- Short-termism. The tendency to focus attention on short-term earnings at the expense of long-term success and stability, mainly as a consequence of the difficulty of calculating long-term risk. Positive interest rates reduce future values, causing investors to opt to finance short-term projects in preference to long-term financing (which would include environmental protection, education, etc).

- Obligatory nature of continuous growth. Growth is too frequently confused with progress. The first is an increase in the size or capacity of an entity, while the second refers to the idea that the world can become an increasingly better place. It cannot be automatically assumed that all growth leads to progress. In addition, money created as bank debt is created with interest and is therefore subject to compound interest, which automatically implies rampant exponential growth. And, in a finite world, exponential growth is incompatible with sustainability.

- Concentration of wealth. The current monetary system includes three systemic mechanisms that lead to the concentration of wealth: interest, the money creation process and the role of lobbyists. The concentration of wealth is not merely a question of justice, economic development itself being dependent on a minimum amount of equity.

- Devaluation of social capital. How can the participants in a monetary system essentially fuelled by competition, fear, mistrust and anxiety be expected to act with cooperation, responsibility, trust and social cohesion?

The unsustainability brought about by the current monetary system translates into reduced potential for the sustainable development of local, regional and national communities. These phenomena are not only caused by imperfect monetary policies, permissive regulations and unhealthy banking practices, but rather by the structural instability of the monetary and banking system itself. The system’s vulnerability stems from its own structure, which is a legacy from the beginning of the industrial era. This structure lacks the agility and adaptability needed to deal with the rapid changes in the economic and social environment that characterize our post-industrial era. It lacks the necessary “resilience” , a term which we will develop further later in this COURSE. Any efforts made within the system are geared exclusively toward improving the system’s efficiency in price formation and trading, the value of which will be included in the indicators used to evaluate the prosperity of the society in question. In this way, activities and goods which are not considered efficient, or which lack market value, are excluded from the system and not included in the calculation of those indicators.