2.3. Characteristics

2.3.2. Issue process

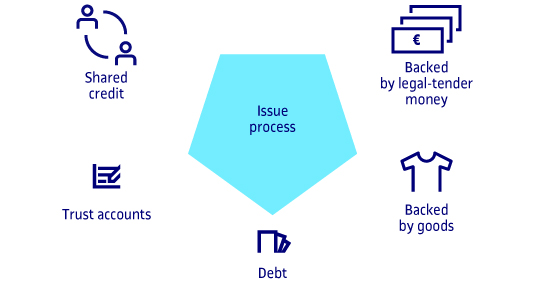

Irrespective of the typology and primary scope of the activity in which they are engaged, complementary currencies can be created or issued in different ways.

- Currencies based on shared credit. Among these currencies we find mutual exchange systems, service credit systems and barter markets. In these cases, the currency represents an exchange owed to other members of the same community, calculated as a credit or positive balance to the member that provides the product or service, and a debit or negative balance to the member that receives it.

- Currencies backed by legal-tender money. The simplest and most solvent method to implement, these currencies rely on a generalized confidence in the value of conventional money. To start the process, the monetary issue must be acquired or backed with a fund of legal-tender currency. The new currency can then be used within a clearly-defined geographical area, usually local or regional, by the economic actors participating in the system. One of the viability criteria for businesses is that these currencies can subsequently be exchanged for legal tender currency, though often with a percentage penalty to enhance the sustainability of the system.

- Trust-based currencies. These currencies are based on exchange values created without any kind of backing and introduced into a circuit to be used as a medium of exchange of goods and services. All participants receive the same amount, whether as an initial sum upon registration, at regular intervals as a basic income, or other arrangement.

- Currencies backed by goods. The issue of these currencies is backed by a certain commodity, which must be available in sufficient quantities. Electric energy, a company’s unsold stock, or a collective’s agricultural produce are a few examples. These systems are rare in Spain, and generally fall outside the scope of intervention of public-sector actors.

- Currencies issued as debt. The currency is issued as a bond for funding certain projects. The currency acts as a document for deferred payment of an initial deposit in legal-tender money, and is circulated among the actors who accept the promise to pay the debt. The amount of the initial deposit can eventually be recovered in legal-tender money or ‘spent’ on goods or services. These kinds of currencies can make sense for the funding of initiatives by heavily indebted local authorities needing to deal with cash flow deficits or community projects.